INTRODUCTION – In today’s time having an account with SBI is more rewarding now, you can avail SBI YONO App personal loan instantly at your convenience on 24*7 basis through YONO app or internet banking in just few clicks.

Presently this loan is being offered to a category that has saving bank account in SBI and handsomely maintain account are pre-selected on certain parameters.

Instant disbursement of pre-approve personal loan (PAPL) up to 15 lacs without documentations an without any branch visit available 24*7

Advantages of SBI YONO App personal loan

- This loan offered very low processing fees.

- Instant process and disbursement in just few clicks.

- Paperless work with availability of 24*7.

- No need to come to branch visit.

- Loan available for salaried, non salaried, pensioner and family pensioner. (they all are eligible for SBI YONO)

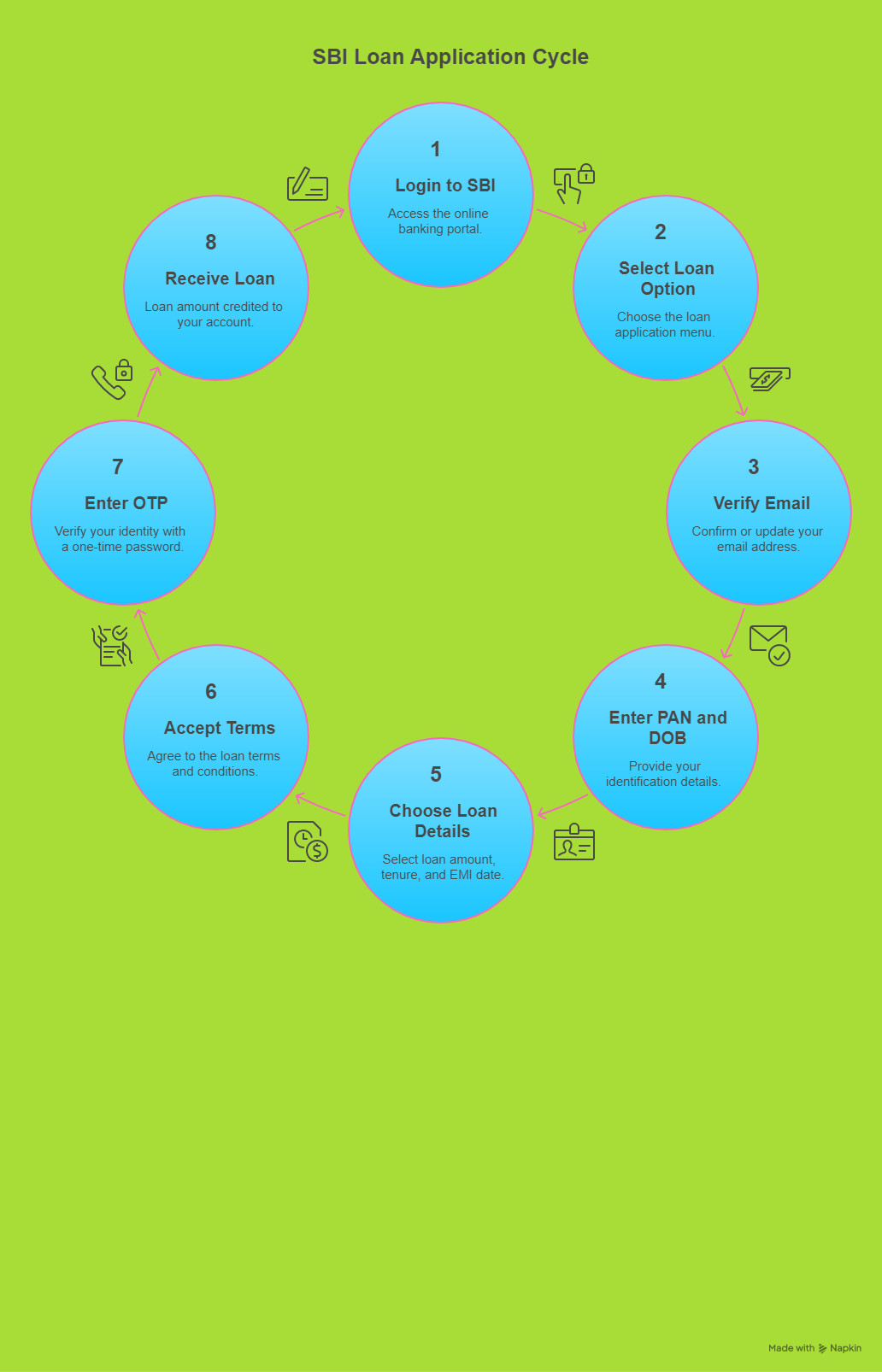

Process to apply for SBI YONO App personal loan

Step 1 – login to https://onlinesbi or https://retailonlinesbi.sbi/retail/login.htm

Step 2 – click on loan offer banners/e-service menu loan option.

Step 3 – verify/change email id

Step 4 – put your PAN number and DOB.

Step 5 – select your loan amount which you needed, tenure and date of EMI.

Step 6 – Accept given terms and condition.

Step 7 – Enter OTP from your mobile number.

Step 8 – Amount will credited to your SBI account very soon.

You can understand above mention process with graph as well

Process to apply from mobile SMS

SMS “ PAPL” (Pre approved personal loan) < space > < last 4 digit of SBI saving bank account number and send it to “567676” to check your eligibility.

Complete Guide how to apply on SBI YONO App personal loan

Downloads and Install the SBI YONO App –

Start by downloading the YONO App from Google play store/app store. The app is available for both Android and IOS devices.

Login or Register

If you are existing SBI customer, log in the YONO SBI app using your own credentials.

Explore to pre-approved loans

After logging in, you will see pre-approved personal loan offer, banner on the homepage based on your eligibility. You can access it through the hamburger menu and go to offer and check it.

Offer Details

Just click on your pre-approved personal loan and valuate or enter your permanent account number which is widely known as PAN number, date of birth, the desired loan amount, tenure or time of period and preferred re-payment date of EMI.

Review and confirm

- Take time to review the instant loan approval amount, rate of interest and re-payment terms, then confirm your acceptance in few clicks.

- This has to insure that complete transparency allowing you to apply for an instant personal loan with confidence.

Accept Terms and Conditions

You need to accept the terms and conditions (T&C) and enter through one time password (OTP) through your register mobile number.

Access Funds Instantly

After completing all above process successfully the sanction loan amount will be instantly credited to your designated bank account. You can use this fund for your personal purpose without any further delays. YONO SBI the streamlines the process, providing quick access to funds without unnecessary delays.

Important tips for smooth loan application

- Keep your PAN card number and date of birth details for processing through SBI YONO App.

- Remember reading the term and condition before accepting any loan offer is essential.

Conclusion(SBI YONO App personal loan)

I hope you may understand to above mention information so that you can take benefit out of it because whenever life turns any difficulties only your own saving and loans play a vital role to assist you, SBI YONO App personal loan is one of them because it is safe and secure mode due to digitization process.

FAQs

Q. 1 – what is PAPL?

Ans. – PAPL is pre-approved personal loan which is made by banks to fulfil customers’ argents financial needs.

Q. 2 – what is the maximum amount offer under PAPL?

Ans. – The maximum loan amount offer under PAPL is Rs. – 5, 00,000 lacs.

Q. 3 – How could i know my loan eligibility under PAPL loan?

Ans. – You can check your eligibility by sending SMS on 567676 from your mobile along with last 4 digit saving bank account number.

Q. 4 – What is the re-payment period of PAPL?

Ans. – The maximum re-payment period of PAPL loan is from 6 months to 84 months.

Q. 5 –C an i pre- close my PAPL account?

Ans. – Yes, you can pre-close your accounts through App/RINO or by visiting the home branch.

Q. – 6 Can i take PAPL loan top-up?

Ans. – No, you cannot take PAPL loan top-up.

One Response